The first strange thing that jumped out to me from Bullard's presentation is that he cites Michael Woodford's Optimal Monetary Stabilization Policy chapter as a defense of the Fed's performance since 2008. (Woodford is arguably the world expert on optimal monetary policy.) Bullard argues that prices have approximately tracked a 2% growth rate since 2008 and that is what is delivered by Woodford's optimal policy rule. Specifically Bullard presents a graph from Woodford of how prices should behave if the central bank is following optimal monetary policy in response to a shock to the economy. However beneath the graphs it says response to a transitory cost push shock. Is Bullard arguing that what hit the economy in 2008 was a cost push shock? I think most rational people would say that we had a massive demand shock in the form of a collapse in asset values. I had not read Woodford's paper though so I suspended judgement.

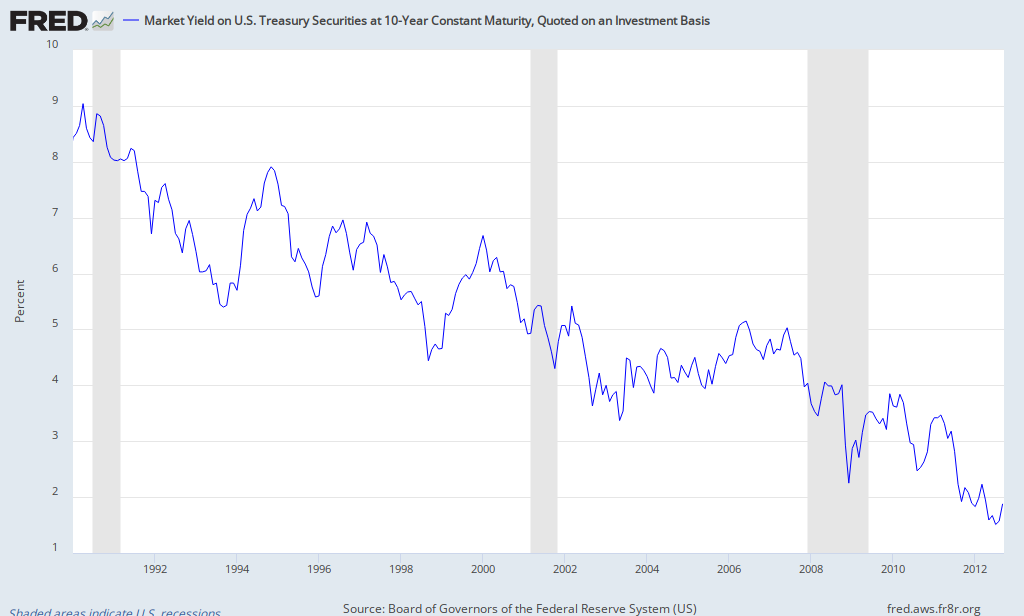

After reading a good chunk of Woodford's paper..no I was right...Bullard is showing optimal response to a cost push shock. Furthermore if you actually read Woodford's paper you will see that he specifically addresses the case that we currently find ourselves in - with short term interest rates effectively at zero - aka the zero lower bound (ZLB) - as being different. Yet Bullard is referring to the generic case where the ZLB does not hold and whats more the graph he cites is a supply shock not a demand shock.

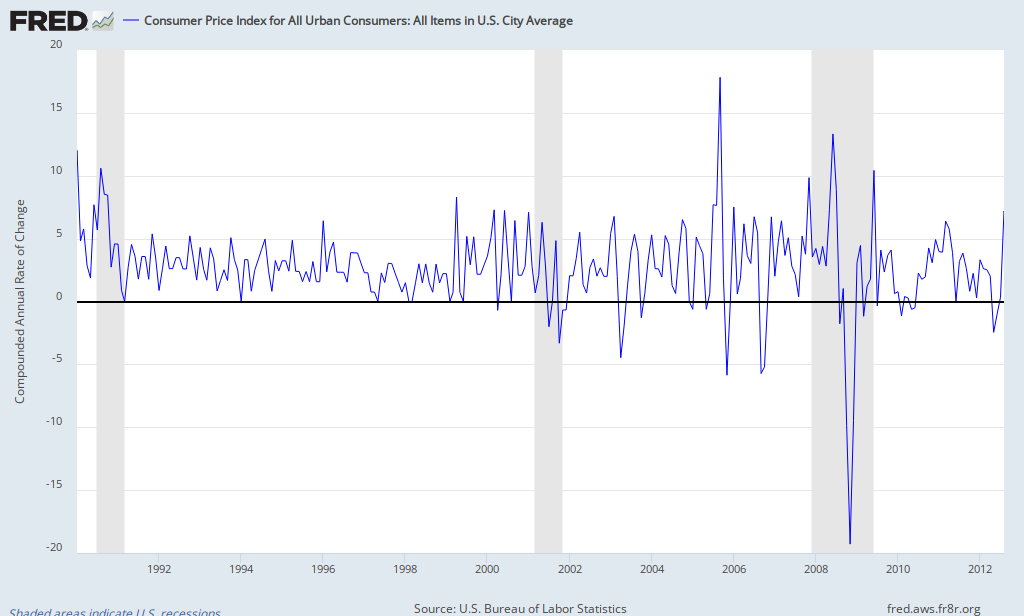

Again is Bullard really arguing that what we experienced in 2008 was a supply shock? If so we would expect to see P spike and Y fall yet we saw P fall even as the Fed was driving rates to zero. What was this huge supply shock that hit the economy? He repeatedly refers to the 2007-2008 financial crisis and Reinhart & Rogoff's This Time Is Different for evidence that after a financial crisis economies tend to grow slowly (btw Pres Obama also cited them). R&R may be correct but that does not mean we had a supply shock. Did part of the US economies capital stock get destroyed in 2008? Did we forget how to employ some technologies? Yes it is possible that credit conditions tightened...but that is more demand side.

Very strange.

Late Note: I really should read more on optimal policy before commenting...but at risk at venturing into a area which I know little about...Let's assume that Bullard is correct and we are not suffering from a demand shock but a supply shock generated by the 2008 credit crisis. And lets further assume that it was in fact a transitory supply shock. He does present a chart of the St. Louis Fed's financial stress index which spiked massively in 2008 - although it still looks high relative to pre-crisis. Note that assuming a transitory shock is is somewhat contrary to R&R's argument that financial crises take years to unwind - but let's go with it. And further lets assume that we did not immediately go to the ZLB (this is stretching reality). Then yes the path for prices that did occur looks like the path that would have resulted from an optimal policy regime. However what does the impulse response (graph) for output versus trend (the output gap) look like under an optimal response to a transitory supply shock? I will bet it does not look like this