I have tried to avoid talk of the whole fiscal cliff. It is a bit overblown. Sure if all of the tax increases and spending cuts go into place and stay in place then it will be contractionary. However if they are just in place for a short time and people believe that they will soon be reversed it should have very mild effect. It is really more like a fiscal 'slow decline'. The biggest impact of failing to avoid the 'cliff' this week may come through expectations. The failure to avoid the 'cliff' will be be strong evidence that Washington has lost the ability to make big tough decisions - and that could hurt the markets (well it already probably has).

However the whole Plan B fiasco is interesting (see here and here). For days Speaker Boehner had been touting his Plan B proposal which would extend tax cuts to all persons with income less than 1MM USD. But the House did not even vote on the bill as the Speaker acknowledged that he did not have the votes on his side of the aisle to pass it. So why go touting Plan B as an alternative if (1) he knows it is a non-starter for the Senate and the President (2) he couldn't get his own caucus to agree to it (3) he was going to get little to no support from House Democrats on it? It ended up making the Speaker look weak and unable to count. It turned out to be a self inflicted wound. So why did he go so public with the plan before he knew he could even get his caucus to support it? Well maybe he really can't count..or...or

The Speaker has two problems (1) he wants to get a bill to avoid going over the 'cliff' for which Republicans will shoulder a disproportionate amount of the blame (2) he wants to get re-elected as Speaker. As Nate Silver pointed out here the Speaker has an arithmetic problem in the House. The House is made up of approximately 186 liberal Democrats, 14 Blue Dog Democrats, 182 establishment Republicans, and 51 Tea Party Republicans. He needs to get 217 votes to pass a bill. If the Speaker wants to pass a bill with just Republican votes he needs 35 of the 51 Tea Party Republicans to go along with it. If he can count on getting all of the Blue Dog Democrats to back his plan he still needs the votes of 21 of the 51 Tea Party Republicans. If he has to count on liberal Democrats to pass a bill then he will have to move the bill in their direction. This will have two bad effects for the Speaker (1) if he moves the bill left he will lose even more of his caucus (2) he could anger some on the right of his party - just at the time that he will need their votes to get re-elected as Speaker.

A few weeks back we heard how a few Republican's were abandoning the no new taxes pledge to Grover Norquist (see here). But the story turned out to be nearly irrelevant. The Senate and President are not going to agree to a bill unless there are some increased revenues (ie taxes on the wealthy) in it. In order to pass such a bill the Speaker doesn't need a few Republicans to abandon the no new tax pledge ...he needs all of the establishment Republicans and nearly half of the Tea Party Republican's to abandon the no new taxes pledge. And that is not going to happen.

So what did - publicly proposing Plan B only to see it fail - do for the Speaker? (1) it may have bought him some time to get past the Speaker's vote. By proposing Plan B it appears that he is trying. Once he is re-elected as Speaker then he can start negotiating with House Democrats on a bill which will include tax increases on the wealthy. But in the mean time he does not want to say that he is stalling for time. (2) It gave him cover with establishment Republicans. By putting up a watered down version of the Obama plan and seeing it shot down in his caucus it demonstrated to establishment Republicans that in order to get a bill that can turn into law the Speaker is going to have to get some House Democrats to support it. Hence he is going to have to move even further left. (3) Or maybe he just can't count.

Monday, December 31, 2012

Sunday, December 30, 2012

More on Egypt's potential currency crisis

Reuters: Egypt pound hits record low under new currency regime

"Prior to Sunday's launch of the new currency regime, the central bank had let the pound weaken by only 6 percent against the dollar since the uprising against Hosni Mubarak in early 2011 chased away tourists and foreign investors, two of the main sources of demand for Egypt's currency....At the maiden auction of the new regime on Sunday, the central bank sold virtually all of the 75 million USD it had offered, with the highest price of pounds at 6.2425 to the dollar, down from 6.185 earlier in the day...The pound subsequently weakened on the interbank market to about 6.30, a fall of 1.8 percent from the morning, smashing through a previous low in October 2004...The auction system means the price of the Egyptian pound will begin to reflect supply and demand more closely, bankers said. The central bank is expected to hold the auctions daily..."The arms of central bank that used to be there will not make (the) market anymore, so it is for first time a real free market," said one banker who works in a treasury room. In a note, Pharos Research forecast a forecast a free float with the pound weakening to 6.50 to the U.S. dollar from about 6.185 now."

Assume Pharos is correct and the central bank can manage a devaluation to 6.50 EGP to the USD - that would not be a disaster in the realm of currency devaluations. The real question is can the bank stop speculators from running against the pound. When you 'smash' through your all times lows there is a tendency for speculators to pile on. The central bank is putting policies in place to try to stem speculation

"As part of the currency adjustment the central bank also imposed a series of measures to dampen demand for foreign currencies, at least in the short term. They included limiting corporate clients from withdrawing more than 30,000 USD in cash per day and charging individuals who buy foreign currencies a 1-2 percent administrative fee, bankers said...Egyptian banks will also not be able to hold long positions in U.S. dollars of more than 1 percent of their capital, down from a previous 10 percent, the bankers added...Under the new regime, withdrawals by individuals will continue to be limited to 10,000 USD a day. All transactions will continue to be monitored to make sure they are for "legitimate" needs and do not involve speculation, bankers said."

Still it would be good if the "exchanger of last resort" were to appear - with a big hammer.

"Prior to Sunday's launch of the new currency regime, the central bank had let the pound weaken by only 6 percent against the dollar since the uprising against Hosni Mubarak in early 2011 chased away tourists and foreign investors, two of the main sources of demand for Egypt's currency....At the maiden auction of the new regime on Sunday, the central bank sold virtually all of the 75 million USD it had offered, with the highest price of pounds at 6.2425 to the dollar, down from 6.185 earlier in the day...The pound subsequently weakened on the interbank market to about 6.30, a fall of 1.8 percent from the morning, smashing through a previous low in October 2004...The auction system means the price of the Egyptian pound will begin to reflect supply and demand more closely, bankers said. The central bank is expected to hold the auctions daily..."The arms of central bank that used to be there will not make (the) market anymore, so it is for first time a real free market," said one banker who works in a treasury room. In a note, Pharos Research forecast a forecast a free float with the pound weakening to 6.50 to the U.S. dollar from about 6.185 now."

Assume Pharos is correct and the central bank can manage a devaluation to 6.50 EGP to the USD - that would not be a disaster in the realm of currency devaluations. The real question is can the bank stop speculators from running against the pound. When you 'smash' through your all times lows there is a tendency for speculators to pile on. The central bank is putting policies in place to try to stem speculation

"As part of the currency adjustment the central bank also imposed a series of measures to dampen demand for foreign currencies, at least in the short term. They included limiting corporate clients from withdrawing more than 30,000 USD in cash per day and charging individuals who buy foreign currencies a 1-2 percent administrative fee, bankers said...Egyptian banks will also not be able to hold long positions in U.S. dollars of more than 1 percent of their capital, down from a previous 10 percent, the bankers added...Under the new regime, withdrawals by individuals will continue to be limited to 10,000 USD a day. All transactions will continue to be monitored to make sure they are for "legitimate" needs and do not involve speculation, bankers said."

Still it would be good if the "exchanger of last resort" were to appear - with a big hammer.

Saturday, December 29, 2012

Egypt's potential currency crisis

Reuters: Egypt starts currency auctions, says reserves critical

"Egypt's central bank introduced a new auction system for buying and selling U.S. dollars to help conserve foreign reserves, which it said had reached a critical level...Reserves fell by 448 million USD in November to 15.04 billion USD, enough to cover barely three months of imports, and bankers said the rush to buy dollars was certain to have drained foreign reserves even further in December. The bank is expected to report December figures in the first week of January."

The Daily News Egypt: Rebel Economy - a good summary of the monetary situation in Egypt.

"Although Egypt officially floated the pound in 2003, it has a policy of managing the pound in what is known as a “managed float rate regime”. That means that the currency rate fluctuates, but is ultimately managed by the Central Bank of Egypt through capital controls and trading of foreign currencies. The Central Bank’s primary tool of supporting the domestic currency is by using the country’s reserves of foreign currency. In short, it has to be willing to meet all of the offers to sell Egyptian pounds at the established rate to keep it at the level it wants. That means the pound’s nominal exchange rate has remained almost unchanged since 2004...So, what’s the problem? The Central Bank cannot carry on using its foreign reserves for much longer. The Central Bank’s policy has led to a rapid decrease in foreign reserves to just 15.04bn USD from 36bn USD in late 2010, a dangerously low level that is just enough to cover three months worth of imports. The two most important sources of foreign currency (which would normally keep foreign reserves replenished), tourism and foreign direct investment, have dried up because of Egypt’s economic crisis."

Question: Are we observing a "first generation" currency crisis or a "second generation" currency crisis? See here

" The 'first generation' of models of currency crises began with Paul Krugman's adaptation of Stephen Salant and Dale Henderson's model of speculative attacks in the gold market.[3] In his article,[4] Krugman argues that a sudden speculative attack on a fixed exchange rate, even though it appears to be an irrational change in expectations, can result from rational behavior by investors. This happens if investors foresee that a government is running an excessive deficit, causing it to run short of liquid assets or "harder" foreign currency which it can sell to support its currency at the fixed rate. Investors are willing to continue holding the currency as long as they expect the exchange rate to remain fixed, but they flee the currency en masse when they anticipate that the peg is about to end.

The 'second generation' of models of currency crises starts with the paper of Obstfeld (1986).[5] In these models, doubts about whether the government is willing to maintain its exchange rate peg lead to multiple equilibria, suggesting that self-fulfilling prophecies may be possible, in which the reason investors attack the currency is that they expect other investors to attack the currency."

It looks pretty first generation to me. Stopping a second generation crisis requires an "exchanger" of last resort. A player big enough to maintain the exchange rate at its current level or punish those who try to attack the currency by pushing it against them. Even if this player never ends up actually being called on to support the currency against an attack, his presence should act to prevent the attack int he first place. A first generation crisis is a bit more difficult to stop because it is not due only to expectations.

"Egypt's central bank introduced a new auction system for buying and selling U.S. dollars to help conserve foreign reserves, which it said had reached a critical level...Reserves fell by 448 million USD in November to 15.04 billion USD, enough to cover barely three months of imports, and bankers said the rush to buy dollars was certain to have drained foreign reserves even further in December. The bank is expected to report December figures in the first week of January."

The Daily News Egypt: Rebel Economy - a good summary of the monetary situation in Egypt.

"Although Egypt officially floated the pound in 2003, it has a policy of managing the pound in what is known as a “managed float rate regime”. That means that the currency rate fluctuates, but is ultimately managed by the Central Bank of Egypt through capital controls and trading of foreign currencies. The Central Bank’s primary tool of supporting the domestic currency is by using the country’s reserves of foreign currency. In short, it has to be willing to meet all of the offers to sell Egyptian pounds at the established rate to keep it at the level it wants. That means the pound’s nominal exchange rate has remained almost unchanged since 2004...So, what’s the problem? The Central Bank cannot carry on using its foreign reserves for much longer. The Central Bank’s policy has led to a rapid decrease in foreign reserves to just 15.04bn USD from 36bn USD in late 2010, a dangerously low level that is just enough to cover three months worth of imports. The two most important sources of foreign currency (which would normally keep foreign reserves replenished), tourism and foreign direct investment, have dried up because of Egypt’s economic crisis."

Question: Are we observing a "first generation" currency crisis or a "second generation" currency crisis? See here

" The 'first generation' of models of currency crises began with Paul Krugman's adaptation of Stephen Salant and Dale Henderson's model of speculative attacks in the gold market.[3] In his article,[4] Krugman argues that a sudden speculative attack on a fixed exchange rate, even though it appears to be an irrational change in expectations, can result from rational behavior by investors. This happens if investors foresee that a government is running an excessive deficit, causing it to run short of liquid assets or "harder" foreign currency which it can sell to support its currency at the fixed rate. Investors are willing to continue holding the currency as long as they expect the exchange rate to remain fixed, but they flee the currency en masse when they anticipate that the peg is about to end.

The 'second generation' of models of currency crises starts with the paper of Obstfeld (1986).[5] In these models, doubts about whether the government is willing to maintain its exchange rate peg lead to multiple equilibria, suggesting that self-fulfilling prophecies may be possible, in which the reason investors attack the currency is that they expect other investors to attack the currency."

It looks pretty first generation to me. Stopping a second generation crisis requires an "exchanger" of last resort. A player big enough to maintain the exchange rate at its current level or punish those who try to attack the currency by pushing it against them. Even if this player never ends up actually being called on to support the currency against an attack, his presence should act to prevent the attack int he first place. A first generation crisis is a bit more difficult to stop because it is not due only to expectations.

Wednesday, December 26, 2012

And moving in the opposite direction...

EU Rehn : Extra Austerity Measures not Essential in France-Report

"Further austerity measures are not "essential" in France, European Commissioner for Economic and Monetary Affairs Olli Rehn said in an interview with French daily Le Monde published Friday. French President Francois Hollande has pledged to bring the country's deficit down to 3% of gross domestic product next year from 4.5% in 2012. But growth forecasts, including from national statistics bureau Insee, suggest the economy may not be strong enough for the government to meet that target without extra austerity measures."

France should review 2013 deficit target with EU partners: IMF

"(Reuters) - France should worry more about the credibility of its efforts to cut back on flab in public finances than whether or not it meets the EU's 3 percent of GDP target for the budget deficit immediately, the IMF's mission chief said on Wednesday...Edward Gardner said that in order to respect the 3 percent target the Socialist government would have to carry out even more belt-tightening than already planned, which would weigh on growth that already was likely to be subdued...."Our recommendation is that France discuss the fact in a broader European context (about what would be) the appropriate stance for 2013," Gardner said in a conference call with journalists...Eager to forge his fiscal credibility, President Francois Hollande already aims to carry out a belt-tightening effort that is unprecedented in modern France in order to reach the deficit target..."The importance is really the credibility of the medium-term orientation of policies," Gardner said. "Whether it's 3 or 3.5 percent next year matters less to the extent that France can give reasonable credible assurances about the direction of policies," he added."

Here is the blurb from the IMF

"The International Monetary Fund’s latest annual check-up of the French economy said the country’s economy grew 0.2 percent in 2012. The IMF predicts the economy will grow 0.4 percent in 2013 and that unemployment will rise further...“France has become a less open economy than its European peers over the last decade, which limits the economy’s ability to rebound in the short term, and will constrain growth over the next few years,” said Edward Gardner, an assistant director in the IMF’s European Department and head of the mission that conducted the assessment...To get the economy growing again, France needs to regain competitiveness relative to its main trading partners, according to the IMF...The IMF said the key to growth and employment lies in reforming the structures and institutions that affect the way the country’s economy functions. Such structural reforms should include policies to make the labor market more responsive to the needs of enterprises and at the same time more inclusive for employees, as well as policies to increase competition in product markets. "

"Further austerity measures are not "essential" in France, European Commissioner for Economic and Monetary Affairs Olli Rehn said in an interview with French daily Le Monde published Friday. French President Francois Hollande has pledged to bring the country's deficit down to 3% of gross domestic product next year from 4.5% in 2012. But growth forecasts, including from national statistics bureau Insee, suggest the economy may not be strong enough for the government to meet that target without extra austerity measures."

France should review 2013 deficit target with EU partners: IMF

"(Reuters) - France should worry more about the credibility of its efforts to cut back on flab in public finances than whether or not it meets the EU's 3 percent of GDP target for the budget deficit immediately, the IMF's mission chief said on Wednesday...Edward Gardner said that in order to respect the 3 percent target the Socialist government would have to carry out even more belt-tightening than already planned, which would weigh on growth that already was likely to be subdued...."Our recommendation is that France discuss the fact in a broader European context (about what would be) the appropriate stance for 2013," Gardner said in a conference call with journalists...Eager to forge his fiscal credibility, President Francois Hollande already aims to carry out a belt-tightening effort that is unprecedented in modern France in order to reach the deficit target..."The importance is really the credibility of the medium-term orientation of policies," Gardner said. "Whether it's 3 or 3.5 percent next year matters less to the extent that France can give reasonable credible assurances about the direction of policies," he added."

Here is the blurb from the IMF

"The International Monetary Fund’s latest annual check-up of the French economy said the country’s economy grew 0.2 percent in 2012. The IMF predicts the economy will grow 0.4 percent in 2013 and that unemployment will rise further...“France has become a less open economy than its European peers over the last decade, which limits the economy’s ability to rebound in the short term, and will constrain growth over the next few years,” said Edward Gardner, an assistant director in the IMF’s European Department and head of the mission that conducted the assessment...To get the economy growing again, France needs to regain competitiveness relative to its main trading partners, according to the IMF...The IMF said the key to growth and employment lies in reforming the structures and institutions that affect the way the country’s economy functions. Such structural reforms should include policies to make the labor market more responsive to the needs of enterprises and at the same time more inclusive for employees, as well as policies to increase competition in product markets. "

Finally someone getting serious (maybe)

Bloomberg: Shinzo Abe Approved as Japan’s Prime Minister by Parliament

"Gross domestic product shrank at an annualized 3.5 percent pace in the three months through September after a contraction in the previous quarter, meeting the textbook definition of a recession. The median estimate of analysts surveyed by Bloomberg News is for a 0.5 percent contraction this quarter. Exports slid for a sixth month in November....Abe agreed with his coalition ally Natsuo Yamaguchi of the New Komeito Party yesterday on a policy package that includes “bold monetary easing” to reach an inflation target of 2 percent, bolstering his party’s position in the lower house...The New Komeito party had cautioned in the campaign before this month’s election that forcing the central bank to reach a 2 percent inflation target risked undermining its independence...The agreement with New Komeito also calls for a “large” extra budget for the current fiscal year to March 2013 and deregulation of the energy, environment and health care sectors. .... Consumer prices excluding fresh food, a benchmark monitored by the central bank, haven’t advanced 2 percent for any year since 1997, when a national sales tax was increased...One Bank of Japan policy maker had embraced the idea of open-ended monetary stimulus as early as last month, according to a record of the Nov. 19-20 board meeting released today in Tokyo. The unnamed member said that open-ended easing until the central bank achieves its 1 percent inflation goal is one option, the minutes of the meeting showed. "

Tim Duy: Missing the Big Japan Story

"In my opinion, a higher inflation target by the Bank of Japan is not particularly interesting. After all, the Bank of Japan can't hit the current "goal" of 1 percent inflation. I don't have much faith that renaming the "goal" a "target" and increasing it to 2 percent will be like waving a magic wand. But something much more significant is afoot - the possibility of explicit cooperation, albeit perhaps forced cooperation, between fiscal and monetary authorities. The loss of the Bank of Japan's independence to force the direct monetization of deficit spending is the real story."

Interesting discussion of joint fiscal-monetary policy.

"Gross domestic product shrank at an annualized 3.5 percent pace in the three months through September after a contraction in the previous quarter, meeting the textbook definition of a recession. The median estimate of analysts surveyed by Bloomberg News is for a 0.5 percent contraction this quarter. Exports slid for a sixth month in November....Abe agreed with his coalition ally Natsuo Yamaguchi of the New Komeito Party yesterday on a policy package that includes “bold monetary easing” to reach an inflation target of 2 percent, bolstering his party’s position in the lower house...The New Komeito party had cautioned in the campaign before this month’s election that forcing the central bank to reach a 2 percent inflation target risked undermining its independence...The agreement with New Komeito also calls for a “large” extra budget for the current fiscal year to March 2013 and deregulation of the energy, environment and health care sectors. .... Consumer prices excluding fresh food, a benchmark monitored by the central bank, haven’t advanced 2 percent for any year since 1997, when a national sales tax was increased...One Bank of Japan policy maker had embraced the idea of open-ended monetary stimulus as early as last month, according to a record of the Nov. 19-20 board meeting released today in Tokyo. The unnamed member said that open-ended easing until the central bank achieves its 1 percent inflation goal is one option, the minutes of the meeting showed. "

Tim Duy: Missing the Big Japan Story

"In my opinion, a higher inflation target by the Bank of Japan is not particularly interesting. After all, the Bank of Japan can't hit the current "goal" of 1 percent inflation. I don't have much faith that renaming the "goal" a "target" and increasing it to 2 percent will be like waving a magic wand. But something much more significant is afoot - the possibility of explicit cooperation, albeit perhaps forced cooperation, between fiscal and monetary authorities. The loss of the Bank of Japan's independence to force the direct monetization of deficit spending is the real story."

Interesting discussion of joint fiscal-monetary policy.

Monday, December 24, 2012

OK Wayne ...Let's Do It!

Chicago Tribune: Gun Lobby Defends Call for Armed Guards At Schools

"WASHINGTON (Reuters) - The leader of the gun lobby on Sunday defended his call for placing armed guards in all American schools despite withering criticism of the group's response to the massacre of 20 first-graders in Newtown, Connecticut."

Actually that sounds like a great idea...let's do it. There are approximately 100,000 public schools in the US (see here). Let's put armed guards in each school. But not just one guard. That is not enough protection. If there was just one guard then a psycho-would-be-assailant could come to school shoot the one guard, and then we would be back in the same boat. No we should have maybe 20 guards per school. That should make it pretty safe. So in total 2MM new guards across the country. But not just any mal-trained guards...I want like marines or special ops types...well trained and heavily armed.

Per here the cost for an active military person is approximately 112,000 USD per year. That's a very rough number because the costs include pay, equipment, training, medical care, pensions etc...I assume my special ops guards would cost more than that...let's say 150,000 USD per guard per year. So that comes out to 2MM guards * 150,000 per guard = 300BB USD per year for my new special ops guards. That sounds like a lot of money - but not a problem. We could fund the new special ops school guard force with a tax on the firearms and ammunition industry. After all it was a suggestion by the NRA - the lobbying group for the firearms industry - so I assume they would be in favor of it. Per here the firearms industry generates 30BB USD of revenue per year. No problem...we will just increase the cost of each gun and bullet sold by a factor of ten to pay for my new special ops school guard force.

And finally in order to preserve the quality of the special ops school guard force let's have them report to the federal government ...maybe to the Bureau of Alcohol Tobacco and Firearms...or better yet maybe they could report to the United Nations. And they could fly around in black helicopters. Yeah I like this idea 2MM special ops forces, reporting to the UN, who fly around in black helicopter, and are funded by an enormous tax on the firearms industry.

"If it's crazy to call for putting police and armed security in our schools to protect our children, then call me crazy," National Rifle Association Chief Executive Wayne LaPierre told NBC's "Meet the Press.""

No comment.

"WASHINGTON (Reuters) - The leader of the gun lobby on Sunday defended his call for placing armed guards in all American schools despite withering criticism of the group's response to the massacre of 20 first-graders in Newtown, Connecticut."

Actually that sounds like a great idea...let's do it. There are approximately 100,000 public schools in the US (see here). Let's put armed guards in each school. But not just one guard. That is not enough protection. If there was just one guard then a psycho-would-be-assailant could come to school shoot the one guard, and then we would be back in the same boat. No we should have maybe 20 guards per school. That should make it pretty safe. So in total 2MM new guards across the country. But not just any mal-trained guards...I want like marines or special ops types...well trained and heavily armed.

Per here the cost for an active military person is approximately 112,000 USD per year. That's a very rough number because the costs include pay, equipment, training, medical care, pensions etc...I assume my special ops guards would cost more than that...let's say 150,000 USD per guard per year. So that comes out to 2MM guards * 150,000 per guard = 300BB USD per year for my new special ops guards. That sounds like a lot of money - but not a problem. We could fund the new special ops school guard force with a tax on the firearms and ammunition industry. After all it was a suggestion by the NRA - the lobbying group for the firearms industry - so I assume they would be in favor of it. Per here the firearms industry generates 30BB USD of revenue per year. No problem...we will just increase the cost of each gun and bullet sold by a factor of ten to pay for my new special ops school guard force.

And finally in order to preserve the quality of the special ops school guard force let's have them report to the federal government ...maybe to the Bureau of Alcohol Tobacco and Firearms...or better yet maybe they could report to the United Nations. And they could fly around in black helicopters. Yeah I like this idea 2MM special ops forces, reporting to the UN, who fly around in black helicopter, and are funded by an enormous tax on the firearms industry.

"If it's crazy to call for putting police and armed security in our schools to protect our children, then call me crazy," National Rifle Association Chief Executive Wayne LaPierre told NBC's "Meet the Press.""

No comment.

Sunday, December 16, 2012

The Saudi Arabia of Natural Gas? (minus the sand)

NYTimes: Sending Natural Gas Abroad

"A new and long-awaited report from the Department of Energy has concluded that the government should quickly begin easing restrictions on the export of natural gas to take advantage of the vast new discoveries of a fuel that only a decade ago was in relatively short supply in this country."

The pros of increased natural gas production and export

To put this into context. Currently there are 20 applications for export of natural gas pending (see here) totaling 20 Bcf per day. The lower 48 states currently produce about 73 Bcf per day. (1 Bcf is approximately 100 NYMEX NG size contracts).

"A new and long-awaited report from the Department of Energy has concluded that the government should quickly begin easing restrictions on the export of natural gas to take advantage of the vast new discoveries of a fuel that only a decade ago was in relatively short supply in this country."

The pros of increased natural gas production and export

- increased revenue for the natural gas industry

- reducing dependence of foreign countries on questionable suppliers ie Iran and Russia.

- higher domestic natural gas prices

- potential environmental damage due to fracking

To put this into context. Currently there are 20 applications for export of natural gas pending (see here) totaling 20 Bcf per day. The lower 48 states currently produce about 73 Bcf per day. (1 Bcf is approximately 100 NYMEX NG size contracts).

Saturday, December 15, 2012

The Visible Foot in Action!

DAWN: Gas Shortage Exposes Pakistan’s Energy Crisis

To summarize

See here for more links on this topic

To summarize

- in the early 2000s the Pakistani government made a concerted attempt to shift their automobile energy source from oil/gasoline to compressed natural gas (CNG). The reasons for the policy were two

- Pakistan has domestic natural gas reserves but negligable oil reserves

- natural gas burns cleaner than coal and oil

- in order to promote this switch the government set the price of CNG very low.

- the policy succeeded. 80% of their automotive fleet (3.5MM units) now run on CNG

- Pakistan is now running low on CNG and power / industrial users are competing with gas stations for supply. At current utilization rates Pakistan will exhaust their proven natural gas reserves by 2020.

- Solutions being discussed

- switching back to oil/gasoline.

- importing natural gas from Iran - who is probably desperate for customers due to world sanctions. The US opposes this.

See here for more links on this topic

Thursday, December 13, 2012

Tuesday Was Not a Good Day for the Financial Markets (Or Maybe It Was!)

Wednesday's financial news stories looked suspiciously like the police blotter.

New York Times: Rate Inquiry Accelerates With Arrests In London

"In a sign of the escalation, Britain’s Serious Fraud Office made the first arrests in connection with the rate-rigging inquiry on Tuesday....In a predawn raid, police took three men into custody at their homes on the outskirts of London. One of the men is Thomas Hayes, 33, a former trader at UBS and Citigroup, according to people briefed on the matter who spoke on condition of anonymity. The other two men arrested worked for the British brokerage firm R P Martin, said another person briefed on the matter."

Chicago Tribune: Former Rochdale Securities trader arrested in fraud scheme

"NEW YORK (Reuters) - The FBI arrested a former trader at the Connecticut firm Rochdale Securities on Tuesday in a fraud scheme involving Apple stock, U.S. prosecutors said. According to a criminal complaint filed in federal court on Monday, David Miller bought Apple shares for himself ahead of the tech giant's October 25 earnings announcement, then told his employer Rochdale the trade was for a customer who would bear the risk if it lost money."

Bloomberg: Deutsche Bank Says Co-CEO Fitschen Subject of CO2 Probe

"Deutsche Bank AG (DBK) co-Chief Executive Officer Juergen Fitschen and Stefan Krause, the firm’s chief financial officer, are subjects of a tax probe involving the sale of carbon-emission certificates that led to five arrests and police raids on the lender’s Frankfurt offices."

Reuters: Former MF Global trader pleads guilty in $141 mln trading loss

"A rogue trader for now-bankrupt futures brokerage MF Global pleaded guilty on Tuesday to violating commodities trading laws in 2008, causing $141 million in losses. Evan Dooley, who worked in MF Global's Memphis office, made a series of overnight bets in wheat futures on CME Group's electronic trading system, even though he knew he did not have money to cover potential losses, according to the U.S. Attorney's office in Chicago."

Did I miss a Lindsey Lohan story in there somewhere?

Actually it got me thinking. Which of the below is true?

New York Times: Rate Inquiry Accelerates With Arrests In London

"In a sign of the escalation, Britain’s Serious Fraud Office made the first arrests in connection with the rate-rigging inquiry on Tuesday....In a predawn raid, police took three men into custody at their homes on the outskirts of London. One of the men is Thomas Hayes, 33, a former trader at UBS and Citigroup, according to people briefed on the matter who spoke on condition of anonymity. The other two men arrested worked for the British brokerage firm R P Martin, said another person briefed on the matter."

Chicago Tribune: Former Rochdale Securities trader arrested in fraud scheme

"NEW YORK (Reuters) - The FBI arrested a former trader at the Connecticut firm Rochdale Securities on Tuesday in a fraud scheme involving Apple stock, U.S. prosecutors said. According to a criminal complaint filed in federal court on Monday, David Miller bought Apple shares for himself ahead of the tech giant's October 25 earnings announcement, then told his employer Rochdale the trade was for a customer who would bear the risk if it lost money."

Bloomberg: Deutsche Bank Says Co-CEO Fitschen Subject of CO2 Probe

"Deutsche Bank AG (DBK) co-Chief Executive Officer Juergen Fitschen and Stefan Krause, the firm’s chief financial officer, are subjects of a tax probe involving the sale of carbon-emission certificates that led to five arrests and police raids on the lender’s Frankfurt offices."

Reuters: Former MF Global trader pleads guilty in $141 mln trading loss

"A rogue trader for now-bankrupt futures brokerage MF Global pleaded guilty on Tuesday to violating commodities trading laws in 2008, causing $141 million in losses. Evan Dooley, who worked in MF Global's Memphis office, made a series of overnight bets in wheat futures on CME Group's electronic trading system, even though he knew he did not have money to cover potential losses, according to the U.S. Attorney's office in Chicago."

Did I miss a Lindsey Lohan story in there somewhere?

Actually it got me thinking. Which of the below is true?

- there is more financial crime now than there used to be

- more financial activities are now considered criminal

- there is better enforcement of securities/commodities laws today than there used to be

- financial crimes are now considered newsworthy

- it is just my imagination

More on State Dependent Fed Policy

Business Insider: Fed Announces Evans Rule

So named for Fed Governor Charles Evans who had proposed the new policy.

Goldman's Jan Hatzius predicted the change last year.

Washington Post: Michael Woodford on the new Fed policy

"Michael Woodford, a Columbia University economist and leading monetary theorist, wrote a crucial paper at the Jackson Hole economic symposium in August arguing that central banks need to use their influence over expectations to boost the economy when interest rates are at the zero lower bound. In that sense, he is among the intellectual godfathers of the new Federal Reserve policy announced Wednesday. "

The Atlantic: The Man Who Occupied the Fed: How Charles Evans Saved the Recovery

Very good writeup on the Fed's two new policies (1) announcing a state dependent policy (2) move from Operation Twist to QE (whatever). And also a mention of how state dependent policy may be a step on the road to NGDP targeting.

So named for Fed Governor Charles Evans who had proposed the new policy.

Goldman's Jan Hatzius predicted the change last year.

Washington Post: Michael Woodford on the new Fed policy

"Michael Woodford, a Columbia University economist and leading monetary theorist, wrote a crucial paper at the Jackson Hole economic symposium in August arguing that central banks need to use their influence over expectations to boost the economy when interest rates are at the zero lower bound. In that sense, he is among the intellectual godfathers of the new Federal Reserve policy announced Wednesday. "

The Atlantic: The Man Who Occupied the Fed: How Charles Evans Saved the Recovery

Very good writeup on the Fed's two new policies (1) announcing a state dependent policy (2) move from Operation Twist to QE (whatever). And also a mention of how state dependent policy may be a step on the road to NGDP targeting.

Have the Invisible Bond Market Vigilante's Given Up?

Bloomberg: Bernanke Critics Can't Fight Bonds Showing No Inflation

"The bond market shows that, two years after the Fed’s second round of asset purchases sparked criticism from Republicans predicting a surge in prices, there’s no incipient anxiety of such risk. That confidence in Bernanke’s ability to keep inflation in check bolsters policy makers’ case for expanding their third round of so-called quantitative easing at the two-day meeting that began yesterday."

Once again monetary stimulus does not directly lead to higher prices. Quoting myself here

"The inflation hawks seem to consistently skip some important steps in the inflation process. First high growth in the monetary base (currency + bank reserves ie what the Fed directly affects through open market operations) and reduction in the Fed Funds target rate does not necessarily lead to greater credit expansion. It only does so if banks see creditworthy customers at the current interest rate - which may not be the case during a major recession. These are the points made by Stiglitz Weiss and Bernanke Gertler Gilchrist. Secondly credit only expands if there is demand for funds at any positive interest rate. This is just Keynes liquidity trap. Finally credit expansion does not directly lead to inflation. Rather credit expansion leads to increased aggregate demand which in the absence of increased aggregate supply will lead to inflation. But so long as there is significant slackness in the economy credit expansion first acts to sop up the excess capacity. This is just basic supply and demand."

"The bond market shows that, two years after the Fed’s second round of asset purchases sparked criticism from Republicans predicting a surge in prices, there’s no incipient anxiety of such risk. That confidence in Bernanke’s ability to keep inflation in check bolsters policy makers’ case for expanding their third round of so-called quantitative easing at the two-day meeting that began yesterday."

Once again monetary stimulus does not directly lead to higher prices. Quoting myself here

"The inflation hawks seem to consistently skip some important steps in the inflation process. First high growth in the monetary base (currency + bank reserves ie what the Fed directly affects through open market operations) and reduction in the Fed Funds target rate does not necessarily lead to greater credit expansion. It only does so if banks see creditworthy customers at the current interest rate - which may not be the case during a major recession. These are the points made by Stiglitz Weiss and Bernanke Gertler Gilchrist. Secondly credit only expands if there is demand for funds at any positive interest rate. This is just Keynes liquidity trap. Finally credit expansion does not directly lead to inflation. Rather credit expansion leads to increased aggregate demand which in the absence of increased aggregate supply will lead to inflation. But so long as there is significant slackness in the economy credit expansion first acts to sop up the excess capacity. This is just basic supply and demand."

State Dependent Federal Reserve Policy

Washington Post: Huge News Out of the Federal Reserve

"Federal Reserve policymakers unveiled a huge surprise this afternoon. The central bank has now laid out specific numbers for the inflation and unemployment rates that will lead it to start thinking about raising interest rates."

It has long been understood that the Fed sets their policy instrument - the federal funds rate - to balance unemployment/ output and inflation. If the economy slows and unemployment increases it is understood that the Fed will lower the fed funds rate to stimulate the economy. If the economy speeds up and inflation picks up then it is understood that the Fed will raise the fed funds rate to slow the economy. But the Fed has not always been explicit about when and under exactly what conditions they will move from one regime to the other. Prior to 1994 the Federal Reserve did not even announce where they were setting their target for the fed funds rate. That had to be inferred by where interest rates ended up after the Fed had taken action.

Starting in 1994 the Federal Reserve Open Market Committee (FOMC) began announcing targets for the fed funds rate. In the post-meeting FOMC statement there was general discussion of the current state of the economy and a target level for the fed funds rate but it was still left to the public to divine from the level of the rate target what balance of inflation versus unemployment led to their decision.

Starting in the 1990s John Taylor and others began looking at the Fed's past decisions and modelling what rule the Fed appeared to be using to set interest rates ie what weights they were putting on inflation and unemployment in deciding where to set the fed funds rate....these became known generically as Taylor Rules. Some even suggested that the Fed should announce a specific Taylor Rule that they would adhere to. This would reduce uncertainty about their future actions.

Over the past few years the FOMC policy statements have contained both a target for the current fed funds rate as well as guidance as to how long they intended to persist that target rate. The hope was that by reducing uncertainty about the Fed's future policy stance - firms and consumers would face less future interest rate risk - and hence be willing to increase long term term investments. Here is an example from FOMC's October 24, 2012 statement

"To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens. In particular, the Committee also decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that exceptionally low levels for the federal funds rate are likely to be warranted at least through mid-2015."

With yesterday''s announcement the FOMC changed the form of guidance that they will provide to the public. Now instead of announcing for how long they intend to persist the current fed funds rate they gave us explicit states of the world under which they would keep rates low. From the FOMC's December 12, 2012 statement

"To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In particular, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. The Committee views these thresholds as consistent with its earlier date-based guidance. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent."

What is the next step in the Fed's policy progression? NGDP targeting maybe?

"Federal Reserve policymakers unveiled a huge surprise this afternoon. The central bank has now laid out specific numbers for the inflation and unemployment rates that will lead it to start thinking about raising interest rates."

It has long been understood that the Fed sets their policy instrument - the federal funds rate - to balance unemployment/ output and inflation. If the economy slows and unemployment increases it is understood that the Fed will lower the fed funds rate to stimulate the economy. If the economy speeds up and inflation picks up then it is understood that the Fed will raise the fed funds rate to slow the economy. But the Fed has not always been explicit about when and under exactly what conditions they will move from one regime to the other. Prior to 1994 the Federal Reserve did not even announce where they were setting their target for the fed funds rate. That had to be inferred by where interest rates ended up after the Fed had taken action.

Starting in 1994 the Federal Reserve Open Market Committee (FOMC) began announcing targets for the fed funds rate. In the post-meeting FOMC statement there was general discussion of the current state of the economy and a target level for the fed funds rate but it was still left to the public to divine from the level of the rate target what balance of inflation versus unemployment led to their decision.

Starting in the 1990s John Taylor and others began looking at the Fed's past decisions and modelling what rule the Fed appeared to be using to set interest rates ie what weights they were putting on inflation and unemployment in deciding where to set the fed funds rate....these became known generically as Taylor Rules. Some even suggested that the Fed should announce a specific Taylor Rule that they would adhere to. This would reduce uncertainty about their future actions.

Over the past few years the FOMC policy statements have contained both a target for the current fed funds rate as well as guidance as to how long they intended to persist that target rate. The hope was that by reducing uncertainty about the Fed's future policy stance - firms and consumers would face less future interest rate risk - and hence be willing to increase long term term investments. Here is an example from FOMC's October 24, 2012 statement

"To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens. In particular, the Committee also decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that exceptionally low levels for the federal funds rate are likely to be warranted at least through mid-2015."

With yesterday''s announcement the FOMC changed the form of guidance that they will provide to the public. Now instead of announcing for how long they intend to persist the current fed funds rate they gave us explicit states of the world under which they would keep rates low. From the FOMC's December 12, 2012 statement

"To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In particular, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. The Committee views these thresholds as consistent with its earlier date-based guidance. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent."

What is the next step in the Fed's policy progression? NGDP targeting maybe?

Thursday, December 06, 2012

ConocoPhillips Sells Kashagan Stake

Bloomberg: India Bets on Troubled Kashagan to Restart Oil Expansion

"India’s largest oil explorer is attempting to revive a stalled overseas expansion plan by buying into a 46 billion USD project that’s eight years behind schedule and cost twice as much as expected. Oil & Natural Gas Corp. (ONGC) announced the company’s biggest overseas acquisition yesterday, the 5 billion USD purchase of ConocoPhillips (COP)’s 8.4 percent stake in Kazakhstan’s Kashagan project. Touted as the biggest find since the 1960s when it was discovered in 2000, the field beneath the Caspian Sea is expected to produce 370,000 barrels a day from next year."

this news came just a week after this story

Bloomberg: Exxon, Shell Said to Face Delay on Kashagan Output Boost

"Exxon Mobil Corp. (XOM), Royal Dutch Shell Plc (RDSA) and their partners in Kazakhstan’s Kashagan oil field face a delay of at least two years on a plan to boost output 20 percent, reducing the time they have to recoup costs in the 46 billion USD project that’s already running eight years late, according to two people with knowledge of the matter.Kazakhstan has told the partners to put the 5 billion USD step-up plan, taking output to as much as 450,000 from 370,000 barrels day, on hold until they study how the start of production next year affects the deposit, the people said, asking not to be identified because the information is private....Exxon and Shell are seeking operational control as the venture weighs an even more expensive second phase to take production to 1 million barrels a day, 54 percent of Kazakhstan’s 2011 crude output. Work on the interim project, which involves injecting natural gas back into the field to help force out more oil, was due to start this year. President Nursultan Nazarbayev urged the nation to tap domestic gas output to “walk away from dependence” on imports in a January speech. In September, he called for a review of Kashagan’s further expansion plans. "

from Wikipedia

"Kashagan Field is an offshore oil field located in Kazakhstan.[1] The field is situated in the northern part of the Caspian Sea close to the Kazakhstan city of Atyrau. The field was discovered in 2000 and was one of the larger discoveries in that decade, it is estimated that the Kashagan Field has commercial reserves from 9 billion barrels (1.4×109 m3) to 16 billion barrels (2.5×109 m3) of oil. The field is offshore in a harsh environment, where sea ice is present in the winter and temperatures from -35 °C (-31 °F) to 40 °C (104 °F) can be encountered. Commercial production is expected to start by the end of 2012, according to Kairgeldy Kabyldin, the chief executive of Kazakhstan's state oil and gas company KazMunaiGas.[2] It has been designated as the main source of supply for the Kazakhstan-China oil pipeline.[3] Kashagan is considered the world's largest discovery in the last 30 years, combined with the Tengiz Field.[4] CNN Money has tagged Kashagan oil and gas field the most expensive energy project in the world. Its development has already absorbed 116 billion USD, which makes the project one of the most expensive discoveries of the last 40 years..The whole project is expected to cost 187 billion USD and it is expected to start production from the project's experimental program is late 2012 with production of 75,000 barrels (11,900 m3) of oil per day. It should reach a production rate of 1.5 million barrels per day (240,000 m3/d) towards the end of 2010s.[13]."

Let's see...187 BB USD of developments costs for 16 BB barrels = 11.6 USD / barrel in development costs. No idea how this fixed cost compares to other projects. The forward curve for Brent crude currently ranges from 108 USD / barrel for January 2013 to 89 USD / barrel in December 2019 and from the sparse data that I can find it appears that CPC blend crude currently trades at 1-3 USD below Brent.

Is this a sign that

"India’s largest oil explorer is attempting to revive a stalled overseas expansion plan by buying into a 46 billion USD project that’s eight years behind schedule and cost twice as much as expected. Oil & Natural Gas Corp. (ONGC) announced the company’s biggest overseas acquisition yesterday, the 5 billion USD purchase of ConocoPhillips (COP)’s 8.4 percent stake in Kazakhstan’s Kashagan project. Touted as the biggest find since the 1960s when it was discovered in 2000, the field beneath the Caspian Sea is expected to produce 370,000 barrels a day from next year."

this news came just a week after this story

Bloomberg: Exxon, Shell Said to Face Delay on Kashagan Output Boost

"Exxon Mobil Corp. (XOM), Royal Dutch Shell Plc (RDSA) and their partners in Kazakhstan’s Kashagan oil field face a delay of at least two years on a plan to boost output 20 percent, reducing the time they have to recoup costs in the 46 billion USD project that’s already running eight years late, according to two people with knowledge of the matter.Kazakhstan has told the partners to put the 5 billion USD step-up plan, taking output to as much as 450,000 from 370,000 barrels day, on hold until they study how the start of production next year affects the deposit, the people said, asking not to be identified because the information is private....Exxon and Shell are seeking operational control as the venture weighs an even more expensive second phase to take production to 1 million barrels a day, 54 percent of Kazakhstan’s 2011 crude output. Work on the interim project, which involves injecting natural gas back into the field to help force out more oil, was due to start this year. President Nursultan Nazarbayev urged the nation to tap domestic gas output to “walk away from dependence” on imports in a January speech. In September, he called for a review of Kashagan’s further expansion plans. "

from Wikipedia

"Kashagan Field is an offshore oil field located in Kazakhstan.[1] The field is situated in the northern part of the Caspian Sea close to the Kazakhstan city of Atyrau. The field was discovered in 2000 and was one of the larger discoveries in that decade, it is estimated that the Kashagan Field has commercial reserves from 9 billion barrels (1.4×109 m3) to 16 billion barrels (2.5×109 m3) of oil. The field is offshore in a harsh environment, where sea ice is present in the winter and temperatures from -35 °C (-31 °F) to 40 °C (104 °F) can be encountered. Commercial production is expected to start by the end of 2012, according to Kairgeldy Kabyldin, the chief executive of Kazakhstan's state oil and gas company KazMunaiGas.[2] It has been designated as the main source of supply for the Kazakhstan-China oil pipeline.[3] Kashagan is considered the world's largest discovery in the last 30 years, combined with the Tengiz Field.[4] CNN Money has tagged Kashagan oil and gas field the most expensive energy project in the world. Its development has already absorbed 116 billion USD, which makes the project one of the most expensive discoveries of the last 40 years..The whole project is expected to cost 187 billion USD and it is expected to start production from the project's experimental program is late 2012 with production of 75,000 barrels (11,900 m3) of oil per day. It should reach a production rate of 1.5 million barrels per day (240,000 m3/d) towards the end of 2010s.[13]."

Let's see...187 BB USD of developments costs for 16 BB barrels = 11.6 USD / barrel in development costs. No idea how this fixed cost compares to other projects. The forward curve for Brent crude currently ranges from 108 USD / barrel for January 2013 to 89 USD / barrel in December 2019 and from the sparse data that I can find it appears that CPC blend crude currently trades at 1-3 USD below Brent.

Is this a sign that

- US shale (aka tight) oil plus Canadian tar sands have made future supply less of an issue for Western companies (see here)

- Western companies are getting frustrated with the Kazakh government

- Indian and Chinese state oil companies are getting desperate for supply

- all of the above

Saturday, December 01, 2012

WTI or Brent ?

Brent Poised to Depose WTI as Most-Traded Oil Futures

"Daily trading in Brent jumped 14 percent to average 567,000 contracts in the year to Nov. 20 compared with all of 2011, while WTI fell 17 percent to 575,000, according to data from the ICE Futures Europe exchange in London and New York Mercantile Exchange compiled by Bloomberg. The number of Brent futures changing hands has exceeded those for WTI every month from April through October, the longest streak since at least 1995"

But not so fast. From the same story.

"By some measures, WTI remains ahead. Open interest, the number of contracts that have not been closed, remains 30 percent higher for the U.S. futures at 1.5 million lots this year, compared with 1.16 million for Brent, data from the exchanges show...If the WTI volumes that are also registered on ICE’s exchange are added to those on Nymex, the U.S. grade remains the more widely-traded. Combined WTI volumes on ICE and Nymex have averaged 704,152 lots this year. "

What would be more interesting to know is what volume of physical oil cargoes are priced based on each of the two benchmarks. I would suspect that Brent is well out ahead. Although if the IEA is correct (see here) in that the US is on its way to becoming the world's largest oil producer again then I would suspect that WTI will take over the lead role in physical pricing as well.

"Daily trading in Brent jumped 14 percent to average 567,000 contracts in the year to Nov. 20 compared with all of 2011, while WTI fell 17 percent to 575,000, according to data from the ICE Futures Europe exchange in London and New York Mercantile Exchange compiled by Bloomberg. The number of Brent futures changing hands has exceeded those for WTI every month from April through October, the longest streak since at least 1995"

But not so fast. From the same story.

"By some measures, WTI remains ahead. Open interest, the number of contracts that have not been closed, remains 30 percent higher for the U.S. futures at 1.5 million lots this year, compared with 1.16 million for Brent, data from the exchanges show...If the WTI volumes that are also registered on ICE’s exchange are added to those on Nymex, the U.S. grade remains the more widely-traded. Combined WTI volumes on ICE and Nymex have averaged 704,152 lots this year. "

What would be more interesting to know is what volume of physical oil cargoes are priced based on each of the two benchmarks. I would suspect that Brent is well out ahead. Although if the IEA is correct (see here) in that the US is on its way to becoming the world's largest oil producer again then I would suspect that WTI will take over the lead role in physical pricing as well.

Tuesday, November 27, 2012

And the People Rejoiced?

Bloomberg: Greece wins Easier Terms on Debt as EU Hails Rescue Formula

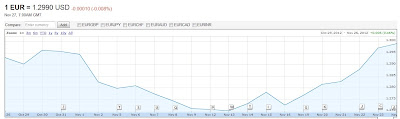

"In the latest bid to keep the 17-nation euro intact, the ministers cut the rates on bailout loans, suspended interest payments for a decade, gave Greece more time to repay and engineered a Greek bond buyback. The country was also cleared to receive a 34.4 billion-euro (44.7 billion USD) loan installment in December. The euro rose to a three-week high on the agreement."

While this was certainly a welcome step, this event was pretty fully anticipated already. From the same story.

"The euro was 0.2 percent higher against the dollar after announcement of the deal on Greece, trading at 1.2992 at 8:25 a.m. in Brussels after reaching 1.3009 earlier. Futures on the Euro Stoxx 50 Index gained 0.7 percent, while contracts on the Standard & Poor’s 500 Index rose 0.2 percent. The MSCI Asia Pacific Index (MXAP) of shares advanced 0.4 percent."

That's the best we can do? The Euro has been saved and it rejoices by moving all of 0.2% ?

Over the last month EUR has varied between 1.27 and 1.30. Less than a 3% range.

Granted we are on the highs right now. However over the last year EUR has varied between about 1.20 and 1.35 so we are sitting squarely in the middle of the range.

Perhaps there will be a more significant follow though later - but this latest event certainly brings into question the hypothesis that what was holding back the world economy was uncertainty about the future of the Euro.

"In the latest bid to keep the 17-nation euro intact, the ministers cut the rates on bailout loans, suspended interest payments for a decade, gave Greece more time to repay and engineered a Greek bond buyback. The country was also cleared to receive a 34.4 billion-euro (44.7 billion USD) loan installment in December. The euro rose to a three-week high on the agreement."

While this was certainly a welcome step, this event was pretty fully anticipated already. From the same story.

"The euro was 0.2 percent higher against the dollar after announcement of the deal on Greece, trading at 1.2992 at 8:25 a.m. in Brussels after reaching 1.3009 earlier. Futures on the Euro Stoxx 50 Index gained 0.7 percent, while contracts on the Standard & Poor’s 500 Index rose 0.2 percent. The MSCI Asia Pacific Index (MXAP) of shares advanced 0.4 percent."

That's the best we can do? The Euro has been saved and it rejoices by moving all of 0.2% ?

Over the last month EUR has varied between 1.27 and 1.30. Less than a 3% range.

Granted we are on the highs right now. However over the last year EUR has varied between about 1.20 and 1.35 so we are sitting squarely in the middle of the range.

Perhaps there will be a more significant follow though later - but this latest event certainly brings into question the hypothesis that what was holding back the world economy was uncertainty about the future of the Euro.

Wednesday, November 14, 2012

Way to be a good loser

Reports: Romney says Obama won by offering 'gifts' to minorities and young voters

"With regards to the young people, for instance, a forgiveness of college loan interest, was a big gift," Romney said. "Free contraceptives were very big with young college-aged women," he continued. "And then, finally, Obamacare also made a difference for them, because as you know, anybody now 26 years of age and younger was now going to be part of their parents' plan, and that was a big gift to young people. They turned out in large numbers, a larger share in this election even than in 2008. You can imagine for somebody making 25,000 or 30,000 or 35,000 a year, being told you're now going to get free health care, particularly if you don't have it, getting free health care worth, what, 10,000 per family, in perpetuity, I mean, this is huge," he said. "Likewise with Hispanic voters, free healthcare was a big plus. But in addition with regards to Hispanic voters, the amnesty for children of illegals, the so-called Dream Act kids, was a huge plus for that voting group."

Sunday, November 11, 2012

Explanations for Why Romney Lost

In the five days since the presidential election there have been literally hundreds of statements by pundits commenting on how the Romney campaign / Republican Party lost the election and what they will need to do going forward. Almost all of the explanations that have been put forward fall into one of five categories. Some arguments straddle multiple categories. Below I will go over a few of the arguments put forward with some commentary. I am probably not bringing much new to the table - just putting the arguments all in one place.

The Messenger - this is a favorite of hard-core conservatives. The message was correct but the messenger was wrong. I am actually somewhat sympathetic to a number of these criticisms.

The Messenger - this is a favorite of hard-core conservatives. The message was correct but the messenger was wrong. I am actually somewhat sympathetic to a number of these criticisms.

- Gov. Romney was unable to make his best case - the Romney campaign started from the premise that people were most concerned about the economy. Exit polls seem to bear that out. In the Edison Research exit poll conducted for the AP 59% of respondents said that the economy was the most important issue to them. However Gov. Romney only won 49-48 among that cohort. Gov. Romney was never able to adequately tie the poor economy to President Obama. 53% of voters blamed President Bush for the bad economy while only 38% blamed President Obama. Nor was Gov. Romney ever able to adequately explain what he would do to improve the economy (see that argument here).

- Gov. Romney had difficulty with the healthcare issue - during the primary Gov Romney was attacked for having implemented RomneyCare (aka ObamaCare light) while serving as governor of Massachusetts. Despite vowing to repeal ObamaCare on day one of a Romney administration he never was able to explain the distinction between the program he was proud of and the one that he was promising to repeal (see here). Among the 18% of exit polled voters who said that health care was the most important issue to them Obama beat Romney by a margin of 75-24 (see here).

- Gov. Romney was an easy target in Ohio - Gov. Romney likely needed to win Ohio to win the presidency. There were other paths that he could have taken to the White House but they were even more improbable. However his association with Bain Capital and his Let Them Go Bankrupt article in the New York Times made it easy to attack him in the auto-lands of Ohio. His TV ad which Chrysler publicly repudiated kept the Ohio focus on his problem with the auto industry - which was right where the Obama campaign wanted it.

- Gov. Romney failed the everyman test - polls asking if Gov Romney understands the concerns of people like you showed him consistently below 50% (see here). The fact that he was the son of a multimillionaire / governor, and that he himself is a multimillionaire and former governor, and that his wife owns and trains show horses all probably didn't help him appear like the everyman. You can't blame him for those things though - he could still understand the concerns of others. However his refusal to release tax returns, his "47% Speech", Rep. Ryan's "Makers-Takers Speech" and his seeming concern for the tax status of the wealthiest 1% all made it all a difficult sell. President Obama consistently rated in the high 50s and low 60s by this metric (see here).

- The primaries sapped Romney's campaign funds - see here for that argument. While the Obama campaign did raise and spend more than the Romney campaign, independent expenditures more than made up for the difference. Per here the Obama campaign plus independent groups supporting Obama spent 396MM. The Romney campaign plus independent groups supporting Romney spent 472MM. Furthermore, while money is extremely important there are declining returns to scale to TV ads. Would more campaign ads in OH really have changed the results of the election?

- The Romney team let the Obama team attack for too long- (here from 4:30 to 6:30) - this sounds like whining to me. This was the most expensive race in history, the Romney team spent more (472MM to 396MM), and spent a higher percent on negative ads (91% to 85%) Hence, it is safe to say that President Obama had more negative ads run against him than anyone in history.

- Inaccurate polling - here and here are reporting that Republican insiders were blindsided by the results of the election as their internal polls showed Romney with a lead in many of the swing states and Republican Senate candidates performing significantly better than they ended up doing. I call bullshit on this one. You did not need to have a fancy Nate-Silver model to look at the general trend of public polls in the swing states and see that Gov. Romney was in trouble- as were a few of the Republican Senate hopefuls. Republican pundits argued that the public polling numbers showing an Obama win were based on faulty voter screens which over-represented Democrats (see here here and here) but they presented no hard evidence of why the screens were wrong (they turned out to be correct). I am sure that the pollsters understood their own polls and could see they were in trouble. If not then they are the worst pollsters ever - since everyone else understood it.

- The Beaching of Project Orca - see here here. The Romney campaign's super-duper get out to vote (GOTV) system may have fallen apart on election day but I doubt that this failure had much impact on the outcome of the election. The swing states had been saturated with election ads - it is unlikely that any call that a swing state voter could receive on election day (short of a call from the candidate himself) could influence which way s/he votes. Furthermore in a presidential election such as this one I doubt that election day GOTV calls have significant impact in turning out voters. If by election day a potential voter was not planning on voting then a call from an unknown person or a robocall is certainly not going to get them out either. Perhaps calling could help in cases where a voter needs assistance getting to the polls - but my experience (yes I have coordinated a few GOTVs) is that as of election day most voters who need such assistance either have already made arrangements or they are not going. In local election years GOTV is very valuable, in midterm years it can be valuable, but in presidential election it is not so useful.

- Increased Hispanic / African American / Asian / youth representation in the electorate. - see here While it is true that these groups turned out in slightly higher numbers than say in 2004 this is not really an explanation for losing. It is kind of like saying "I lost because the people voted against me". There are a number of potential voters. A campaign can to a small degree influence who is registered and who turns out. Other than that you have to appeal to the voters who show up. If you don't then you lose. Why this campaign did not appeal to the voters can be found in other sections.

- Hurricane Sandy made President Obama look good - see here here here and here. Most voters gave the President and the federal government high marks for their response to the hurricane (see here). However it is unlikely that made the whole difference. As Nate Silver pointed out Romney was not leading prior to the hurricane either. As a counter factual if the federal assistance had gone as badly as Hurricane Katrina did (see here) then President Obama would have been blamed for it as President Bush was. The hurricane gave President Obama an opportunity to pass or fail ...and he passed.

- Gov. Chris Christie's embrace of President Obama following Sandy made Obama appear bipartisan - see here here here here. There is probably some truth to this as well. But again Gov Romney was not leading prior to the hurricane either.

- Hurricane Isaac shortened the Republican National Convention depriving Gov. Romney of a chance to define himself -see here. This is a bit of a stretch. Gov. Romney still got a prime time opportunity to speak unfiltered to a national audience. Furthermore, the evidence(see here) is that convention bounces tend to be significant but short lived. Actually if anything contributed to the dampening of the convention bounce it was not Hurricane Isaac but the opportunity lost by having the convention focus turned to Clint Eastwood's bizarre speech to a chair.

- The economy is improving and that helped Obama - yes it is true that the economy is improving however we are still in the deepest economic contraction since the Great Depression. Among exit polled voters 39% said the economy was getting better, 20% said the economy was getting worse, and 29% said no change. That is not a clear winning coalition. Ray Fair's economic model of elections predicted President Obama would get 49% of the popular vote - certainly not the "throw the bums out" vote but also not a clear ringing endorsement. In all likelihood there was an opportunity for Gov. Romney here but not nearly so big a one as was often assumed.

- The Mainstream Media was biased against Romney - see here This is a constant claim from the right wing. Fortunately we have the unbiased view here and here.

- Obama won through massive voter fraud - yup as predicted if Romney lost there would be cries of voter fraud. See here here here here ...there are hundreds more. I will be interested to see if there are any successful prosecutions (other than this one and this one) or just vague allegations meant to delegitimatize President Obama's win.

- The Department of Labor fixed the jobs numbers to make the Obama administration look better- you think this is a joke right? see here here here

- "Mitt Romney told donors on a call Wednesday that President Barack Obama outmatched him by offering "gifts" to African Americans, Hispanics and young voters, according to various news outlets. " - see here.

Friday, November 09, 2012

Project ORCA

Project ORCA was the Romney campaign's super-duper get out to vote

(GOTV) effort - which apparently had some problems. Some are now attributing his loss in part to the mess up.

Here is a pre-election report on Project ORCA

And here is one person's experience with the great whale in action

The Unmitigated Disaster Known As Project ORCA